Individual Stock & Sector Portfolio

A breakdown of my individual holdings and strategic interests.

This is my hobbyist portfolio, where I allocate a portion of my capital to individual companies and sectors that I find personally interesting or innovative. It is important to note that the vast majority of my net worth remains invested in globally diversified, market-weighted ETFs for long-term stability and growth. This list represents my high-conviction "active" bets alongside companies I interact with daily.

Peter Lynch: Invest in What You Know

Peter Lynch's philosophy of "investing in what you know" is a cornerstone of my hobbyist portfolio. Many of my holdings, such as Alphabet (Google), Amazon, Netflix, and Spotify, are services I use daily. By observing the dominance and utility of these brands in my own life, I can better understand their value proposition and market position. This approach allows me to ground my investment decisions in real-world experience and consumer behavior.

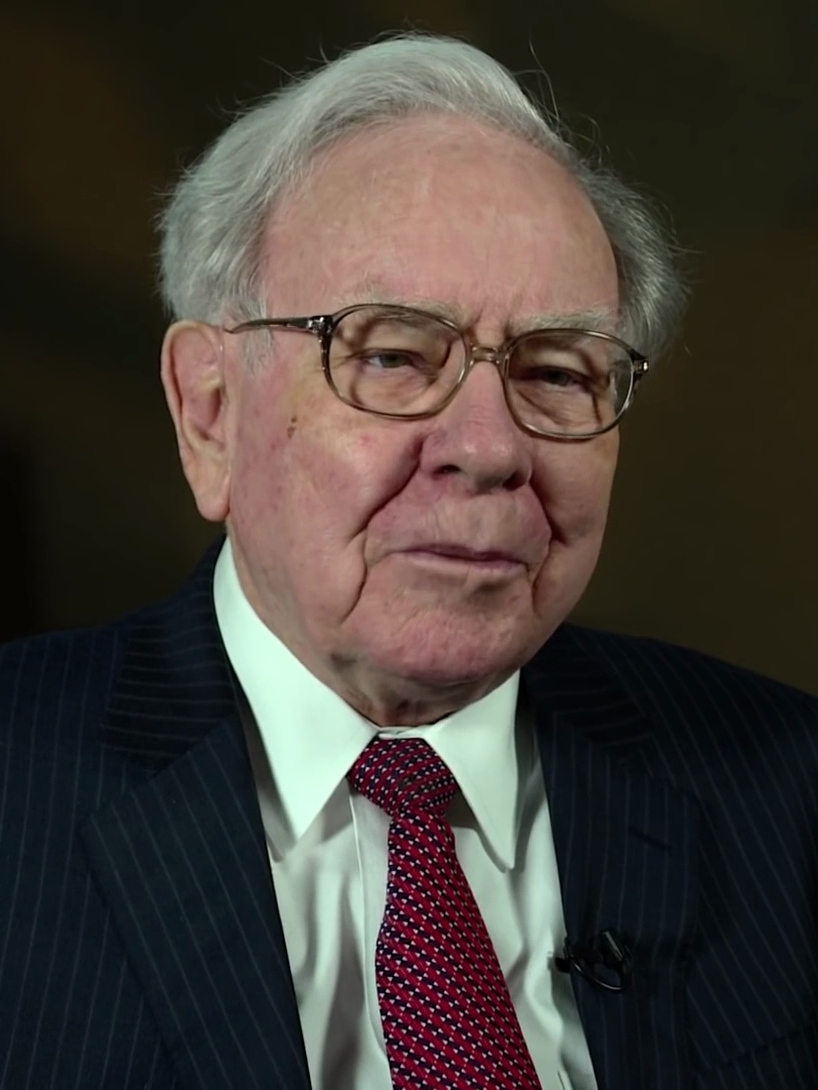

Warren Buffett: The Power of Compounding

Warren Buffett's emphasis on value investing and long-term compounding heavily influences my selection of stable "fortress" companies. My investment in Berkshire Hathaway (BRK.B) and JPMorgan Chase reflects this alignment with high-quality businesses that possess strong competitive moats and reliable management. Much like Buffett, I prioritize companies that can consistently compound capital over decades, providing a solid foundation for the more innovative and speculative areas of my portfolio.

| Ticker | Company | Weight | Reasoning |

|---|---|---|---|

| NASDAQ:GOOGL | Alphabet Inc. | 13.38% | Innovative leader; deeply integrated into daily internet use (Gemini, YouTube). |

| NYSE:MCD | McDonald's Corporation | 7.63% | Personal consumption; reliable global brand with consistent demand. |

| NYSE:WMT | Walmart Inc. | 7.24% | Personal Consumption; dominant retail footprint and reliable consumer staple. |

| NYSE:MAA | Mid-America Apartment Communities | 7.04% | Stable REIT; Personal Consumption (tenant) |

| NYSE:BRK.B | Berkshire Hathaway Inc. | 6.17% | The ultimate stable compounder; aligned with long-term value investing philosophy. |

| NASDAQ:META | Meta Platforms, Inc. | 6.15% | Innovative tech; dominance in social networking and advertising. AI hedge |

| NASDAQ:SHY | iShares 1-3 Year Treasury Bond ETF | 5.88% | Cash management; stability and safety while waiting for opportunities. |

| NASDAQ:AAPL | Apple Inc. | 5.36% | Personal consumption; sticky ecosystem and premium hardware dominance. |

| NASDAQ:ABNB | Airbnb, Inc. | 5.07% | Personal consumption/Innovation; disruptive leader in travel and hospitality. |

| NYSE:DHR | Danaher Corporation | 4.28% | Stable compounder; diversified life sciences and diagnostics leader. |

| NASDAQ:SOFI | SoFi Technologies, Inc. | 3.72% | Innovative fintech; bet on the future of digital banking and lending. |

| NASDAQ:AMZN | Amazon.com, Inc. | 3.70% | Personal consumption/Innovation; essential e-commerce and cloud infrastructure. |

| NYSE:ASEA | Global X FTSE Southeast Asia ETF | 2.74% | International growth; exposure to dynamic and developing Southeast Asian economies. |

| NASDAQ:NFLX | Netflix, Inc. | 2.72% | Personal consumption; leader in streaming entertainment. |

| NASDAQ:TSLA | Tesla, Inc. | 2.45% | Innovative/Personal interest; leader in EVs and energy transition. |

| NASDAQ:COKE | Coca-Cola Consolidated, Inc. | 2.27% | Personal consumption; stable bottling business with strong brand loyalty. |

| NASDAQ:MELI | MercadoLibre, Inc. | 2.25% | International growth/Innovation; dominant e-commerce and fintech platform in Latin America. |

| NASDAQ:MCHI | iShares MSCI China ETF | 2.20% | International growth; exposure to the massive scale of the Chinese market. |

| NYSE:JPM | JPMorgan Chase & Co. | 1.82% | Stable financial fortress; best-in-class banking institution. |

| BATS:INDA | iShares MSCI India ETF | 1.35% | International growth; bet on India's expanding middle class and economy. |

| NYSE:KMX | CarMax, Inc. | 1.29% | Personal consumption; reliable player in the used car market. |

| NASDAQ:NVDA | Nvidia Corporation | 1.11% | Innovative tech; critical infrastructure for AI and computing. |

| NYSE:UBER | Uber Technologies, Inc. | 1.10% | Personal consumption; dominant utility in transportation and delivery. |

| NYSE:ARGT | Global X MSCI Argentina ETF | 0.91% | International growth; speculative bet on economic turnaround in Argentina. |

| NASDAQ:MSFT | Microsoft Corporation | 0.91% | Innovative/Stable; enterprise dominance and cloud growth. |

| NYSE:SPOT | Spotify Technology S.A. | 0.83% | Personal consumption; essential music streaming utility. |